Pension Adjustment Account

Pension Adjustment Account

TRAF grants cost of living adjustments (COLA) to the extent that they can be funded by a designated account known as the Pension Adjustment Account (PAA). The PAA was established in 1977 for the purpose of financing 50% of the COLA granted to retired members. The Province finances the other 50% of the COLA (via a “match” from Account B) as benefit payments are made.

COLA history

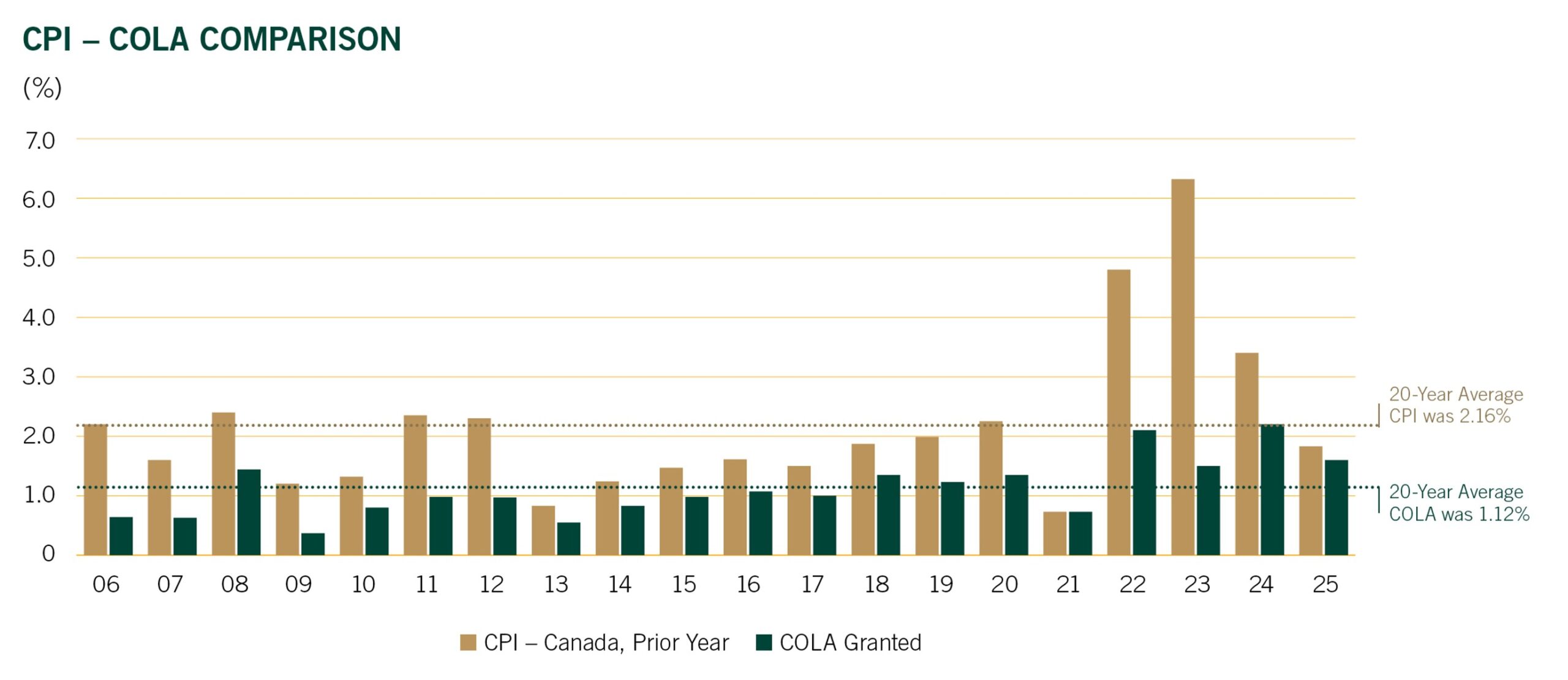

The following chart illustrates the level of COLA over the past 20 years and the corresponding Consumer Price Index (CPI).

Funding the PAA

The PAA is funded with a portion of member contributions plus interest credited on those contributions.

Member contributions

The PAA is currently allocated 16.9% of all member contributions. The percentage of member contributions allocated to the PAA will increase by 0.1% to 17.0% on September 1, 2025. The percentage allocated to the PAA will remain at 17.0% thereafter.

Interest

In addition to member contributions, the PAA receives “interest” on the funds in the account. From the inception of the PAA in 1977 until the end of 2006, the PAA was credited with interest based on fixed income investments. From 2007 through 2016, the PAA was credited with interest equal to the “greater of” the fixed income rate or the total fund rate, determined annually and then averaged over three years.

Starting in 2017, the PAA is credited with interest equal to the average net rate of return on all investments for the current year and the prior two years (the “greater of” formula will no longer apply). While moving to an interest rate equal to the return on all investments is expected to create greater volatility in the amount of future COLA granted, this volatility will be dampened or “smoothed” by maintaining the three-year averaging mechanism.

Determining the COLA

The plan actuary prepares an actuarial valuation as at December 31 of each year to determine the maximum COLA the PAA can support. The actuarial valuation compares the PAA assets to the liabilities for all prior COLA. Liabilities are valued based on a discount rate recommended by the plan actuary. If such liabilities are less than the assets in the PAA, the resulting surplus will be used to support a further COLA. COLA is applied on July 1 to both the base pension (assuming the single life option), as well as all previously granted COLA. Members who have been receiving pension payments for less than 18 months as of July 1 will receive a pro-rated COLA. Beneficiaries of deceased members receive an adjustment to their payments equal to 2/3 of the COLA granted.

Limits on COLA

From 1977 through 1991, COLA was determined using a two-part formula. The first part was an amount per year of service to a maximum of 35 years. The second part was a percentage up to a maximum of the CPI. From 1992 through 2007, COLA was limited to the full increase in CPI. From 2008 through 2017, COLA was limited to 2/3 of the full increase in CPI.

Starting in 2018, COLA is limited to the full increase in CPI. The 2/3 of CPI maximum no longer applies.

COLA can never be negative. In all circumstances, COLA may be further limited to the maximum percentage the PAA can support.

Future COLA

Given the number of variables involved, it is difficult to predict the amount of future COLA. Members are cautioned that there is no certainty of a COLA in any given year and the long-run average COLA could be significantly below the corresponding increase in CPI. Projection analyses conducted by our plan actuary indicate that an average annual COLA of approximately 0.85% could be granted over the next 40 years (subject to annual fluctuations and the CPI limit). While 0.85% is a very precise estimate, it is nevertheless an estimate – it could be higher or lower by a meaningful amount.