Actuarial Valuation Basics

An actuarial valuation is an analysis performed by an actuary that compares the assets and liabilities of a pension plan. Actuarial valuations are necessary to assess the long-term sustainability of a defined benefit pension plan and can serve as a decision-making tool for plan sponsors.

A defined benefit pension plan has financial commitments that will be fulfilled many years in the future. For example, based on our current data, new retirees are expected to receive their pension for an average of 31 years (longer than their average length of service of 26.0 years), with their beneficiaries continuing to receive the benefit for an additional 4.4 years on average. As they will not make contributions during this period, the plan sponsors need to ensure that TRAF will have sufficient assets to make those payments as they become due.

An actuarial valuation determines the value of all plan assets and liabilities as of a specific date. If the value of the plan assets exceeds the value of the liabilities at any point in time, the funded ratio will be greater than 100% and the plan will be considered to be in a “surplus” position. If the liabilities exceed the value of the plan assets, the funded ratio will be less than 100% and the plan is considered to be in a “deficit” position.

Types of actuarial valuations

The focus of TRAF is the actuarial valuation prepared on a “going-concern” basis. A going-concern valuation provides an assessment of a pension plan assuming the plan continues into the future indefinitely.

Assumptions

In conducting an actuarial valuation or when projecting the funded status over the long term, many future events must be assumed, or predicted. Among others, these assumptions include:

- How long members will teach

- What level of salary increases they will receive

- When they will retire

- How long they will live

- How much TRAF will earn on its investments

Considerable time and effort is expended before selecting each actuarial assumption so that TRAF can estimate the future financial condition of the plan. However, it is understood that actual experience can deviate from the assumptions made. TRAF performs stress testing and sensitivity analysis on key assumptions in order to understand the impact of experience deviating from the actuarial assumptions.

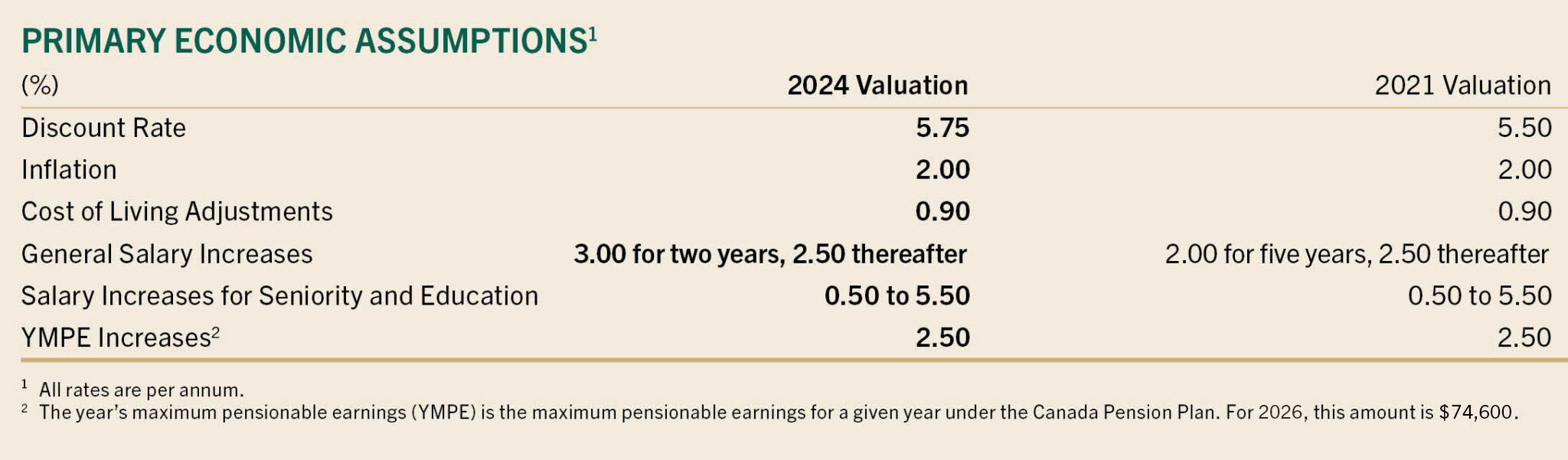

The table below outlines the primary economic assumptions used for the most recent going-concern actuarial valuation, together with those used in the prior valuation for comparison purposes.

The primary non-economic assumptions relate to the incidence of mortality, retirement and termination (i.e., withdrawal from active membership for reasons other than death or retirement). Each of these assumptions is based on estimates developed through applicable experience studies and is considered reasonable by the plan actuary. Demographic assumptions are based on a review of past experience combined with future expectations.

An assumption regarding new plan members is required in order to project the funded status over the longer term. The baseline assumption used is that each member who leaves the plan for any reason is replaced on a one-to-one basis. The demographic profile of new plan members is based on the profile of actual new members who joined the plan in the three years prior to the valuation date.

Actuarial valuation terminology

The actuarial valuation results for TRAF have several components which can be explained and summarized as follows.

| Item | Description |

|---|---|

| Accrued Assets | The assets in the account at the valuation date. |

| Accrued Liabilities | The present value as at the valuation date of the pension obligations that have been earned by current members of the plan. |

| Future Assets | The present value as at the valuation date of all contributions expected to be received from current active members, or the Province, in respect of future service. We assume that the Province will continue to match required member contributions. |

| Future Liabilities | The present value as at the valuation date of the pension obligations expected to be earned in the future by current members of the plan. Account A also includes a liability for future administrative expenses expected to be paid by the plan. |

| Surplus/(Deficit) | Plan assets minus plan liabilities. A surplus exists if plan assets exceed plan liabilities. A deficit exists when plan assets are less than plan liabilities. |

| Funded Ratio | The ratio of assets to liabilities expressed as a percentage. A ratio of 100% or greater indicates that the assets are sufficient to provide the benefits promised as of the valuation date. |

| Funded Status | A comparison of the assets and liabilities of the plan, or of an account (or sub-account) of the plan. Funded status can be expressed in absolute dollar terms as a Surplus or Deficit. Funded status can also be expressed as a percentage using the Funded Ratio. |