Account Structure

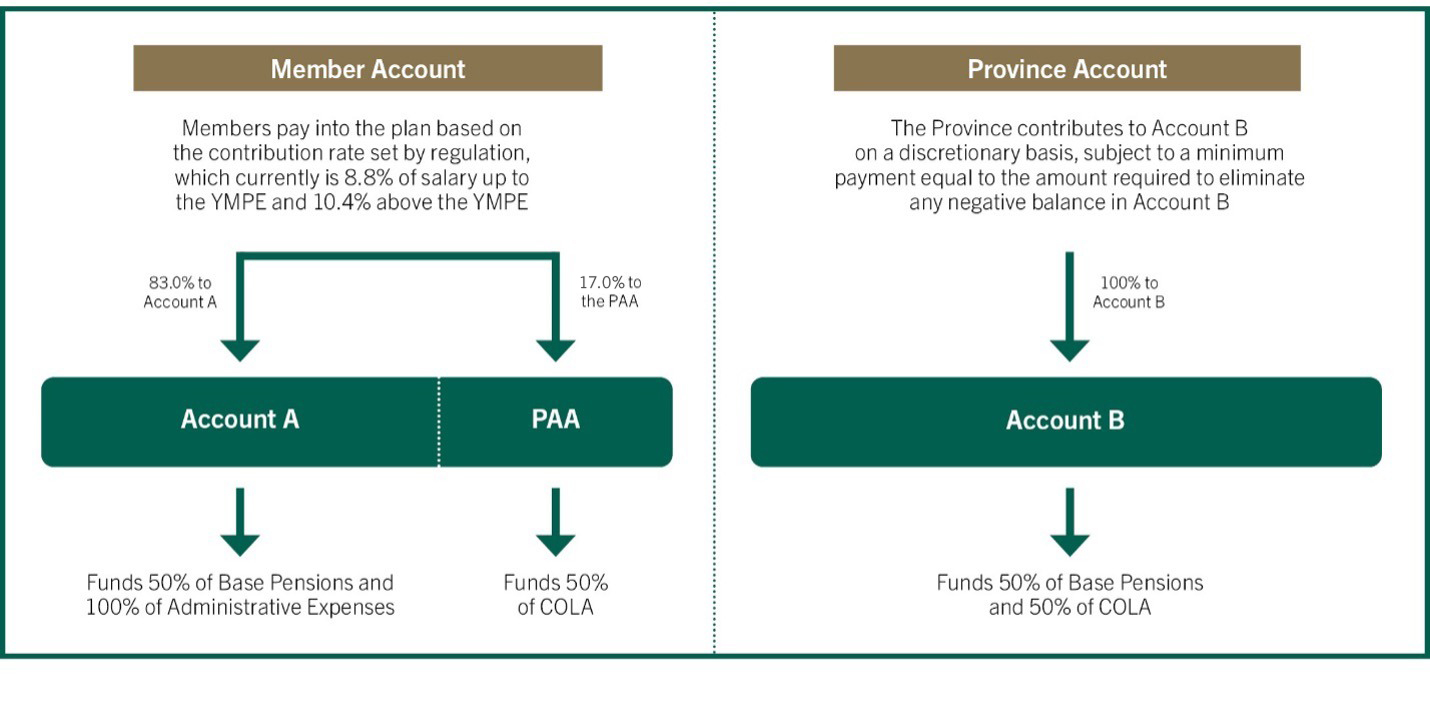

In order to put the funded status of the plan into context, it is necessary to understand TRAF’s account structure and operations, as illustrated in the chart below.

Benefits paid under the plan are primarily funded through two main accounts established under The Teachers’ Pensions Act, namely Account A and Account B. Each account is financed in a different manner. Account A is funded by member contributions and investment income during the working lifetimes of active teachers. Account B is funded by the Province on behalf of the employers on a discretionary basis, subject to a minimum payment equal to the amount required to eliminate any negative balance in Account B.

Account A (Member Account)

Account A is a pre-funded account and is financially responsible for the members’ 50% share of pension obligations. While Account A initially pays 100% of all pensions, it then recovers 50% of such amounts from Account B.

As members accrue service, required contributions are deducted from each member’s salary by the employer and forwarded to TRAF. Contributions received from members are deposited to the credit of Account A, with 83.0% allocated towards basic benefits and 17.0% to a sub-account known as the Pension Adjustment Account (PAA) to support cost of living adjustments (COLA). Further details regarding COLA can be found under the PAA section.

Funds held in Account A are invested in accordance with TRAF’s Statement of Investment Policies & Procedures.

Account B (Province Account)

Account B is financially responsible to reimburse Account A for the Province’s 50% share of pension obligations. While the Province contributes to Account B on a discretionary basis, it has a statutory obligation under The Teachers’ Pensions Act to transfer funds to Account B in an amount sufficient to eliminate any negative balance that arises in Account B as a result of transfers to Account A. Transfers from Account B to Account A are made as pension and other benefits are paid.

MTS & MSBA Accounts

Certain employees of The Manitoba Teachers’ Society (MTS) and Manitoba School Boards Association (MSBA) participate in the TRAF pension plan. MTS and MSBA are responsible for the employer portion of the pension obligations for their respective employees.