Importance of Investment Returns

A significant advantage of a defined benefit (DB) pension plan is the long-term compounding of investment returns on contributions. The contributions that are automatically deducted from active members’ pay cheques are deposited to Account A (the member account), where they are systematically invested in a globally diversified portfolio on a cost-effective basis. Over time, this provides meaningful benefits.

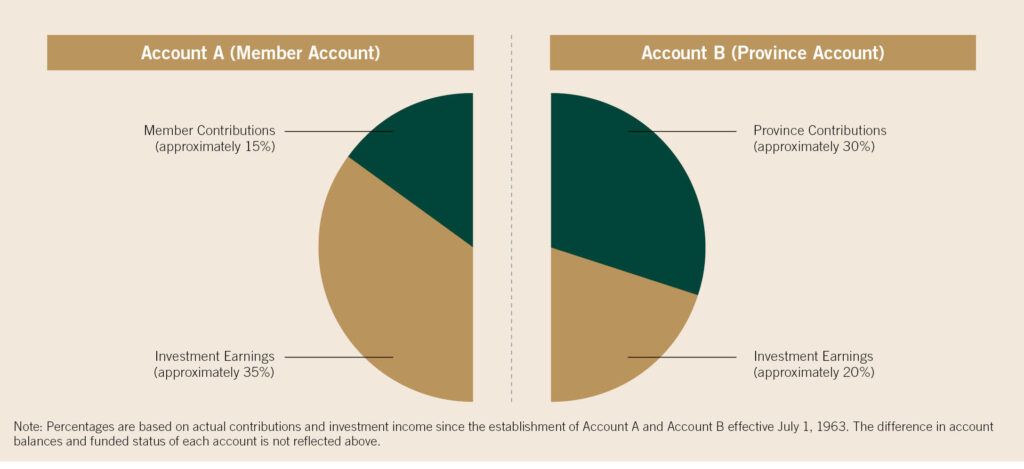

As illustrated in the diagram below, approximately 70% of the increase in Account A assets is attributable to investment income. The other 30% comes from member contributions. This is in contrast to Account B, where 60% is attributable to contributions from the Province and only 40% is from investment income. The reason that the investment income makes up a larger portion of Account A, when compared to Account B, is Account A has been benefiting from investment income since 1963 given its pre-funded structure, while Account B has only benefited from investment income since 2001 when the account started to be partially funded. In addition, Account A is more adequately funded than Account B.

Source of pension funds