Total Plan

January 1, 2024 actuarial valuation results

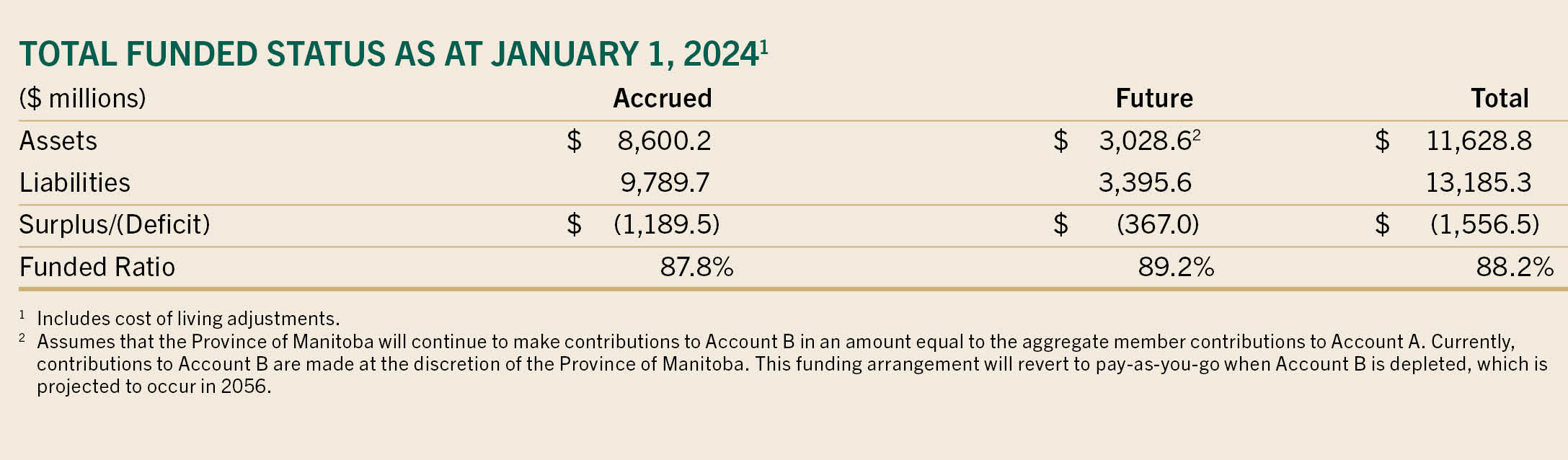

The most recent actuarial valuation of TRAF prepared by the plan actuary was as at January 1, 2024. The valuation results for the total plan (Account A, the Pension Adjustment Account and Account B) are summarized in the following table.

The next actuarial valuation is scheduled to be performed as at January 1, 2027.

Actuarial valuation information

Funding valuations, projection valuations, plan actuary funding recommendations, sensitivity analyses and presentations to our stakeholders are available for plan members to view through Online Services.