Importance of Investment Returns

A significant advantage of defined benefit pension plans like TRAF is the long-term compounding of investment returns on contributions. The contributions that are automatically deducted from active members’ pay cheques are deposited in Account A (the member account), where they are systematically invested in a globally diversified portfolio on a cost-effective basis. Over time, this provides meaningful benefits.

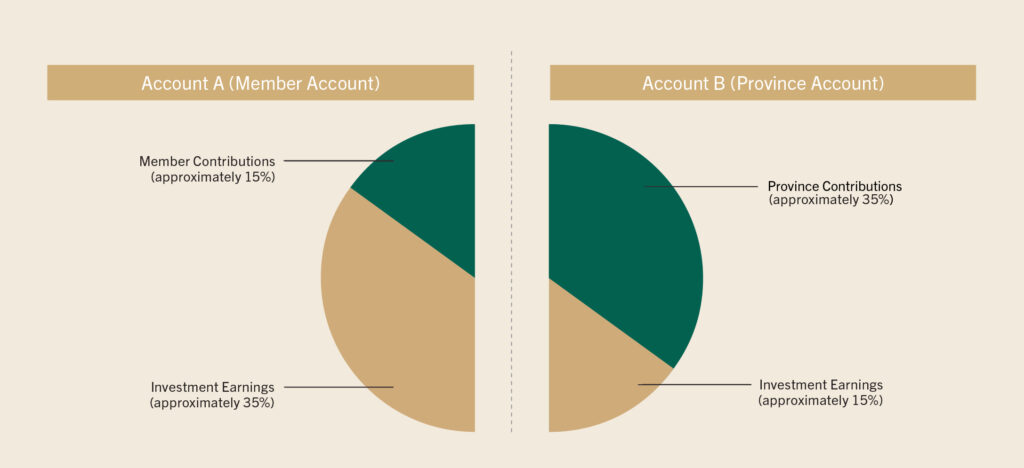

As illustrated in the diagram below, approximately 70% of the increase in Account A assets is attributable to investment earnings. The other 30% comes from member contributions. When combined with the 50% match from the Province (Account B), this means that members generally contribute only about $15 for every $100 that they draw out of the plan during retirement.

This data highlights the power of mandatory contributions and compounding of investment returns over the long term.

Source of pension funds