Understand COLA

Understand COLA

Before you make the important decision to retire, it is important to understand the impact of inflation on the purchasing power of your pension. Cost of living adjustments (COLA), if any, that are granted under the pension plan will increase your pension after retirement; however, the increases are not projected to keep up with inflation. As a result, you should expect and plan for your TRAF pension to lose purchasing power over time.

What is COLA?

COLA is meant to help offset inflation and is granted to the extent it can be funded by a separate account known as the Pension Adjustment Account (PAA). The PAA is funded by a portion of members’ contributions and investment earnings and is responsible for 50% of the COLA granted to eligible retired members or their beneficiaries. The Province funds the other 50% of the COLA as benefit payments are made.

How is COLA determined?

It is determined by a formula set out in The Teachers’ Pensions Act (TPA). COLA is set at the lesser of:

- The maximum percentage the PAA can support, and

- The full increase in the Consumer Price Index (CPI).

COLA can never be negative.

Is COLA guaranteed?

No. There is no guarantee that COLA will be granted every year.

What is inflation and CPI?

Inflation is the general increase in the price of goods and services in an economy, and CPI is one way that inflation can be measured. CPI represents the change in price for a fixed basket of goods and services that the average Canadian is generally expected to purchase in a year. In reality, each Canadian makes unique purchasing decisions; therefore, this may not be reflective of the goods and services you choose to purchase. And in retirement, your purchases and lifestyle may further change.

The goods and services in the CPI basket are divided into eight major components:

- Food

- Shelter

- Household operations, furnishing and equipment

- Clothing and footwear

- Transportation

- Health and personal care

- Recreation, education and reading

- Alcoholic beverages, tobacco products and recreational cannabis

Each item in the basket represents consumer spending patterns and is given a proportionate weight that reflects the relative importance of each good or service, based on its share of total household consumption.

How does inflation impact COLA?

COLA is based on the amount that can be supported by the PAA and is not directly related to the level of inflation, except to the extent that CPI limits COLA in any particular year. As a result, the annual COLA could be significantly below the corresponding level of inflation. As a result, you should expect and plan for your TRAF pension to lose purchasing power over time.

How much COLA should I expect?

Projection analyses conducted by our plan actuary indicate that an average annual COLA of approximately 0.85% could be granted over the next 40 years (subject to annual fluctuations and the CPI limit). As the Bank of Canada targets inflation in the range of 1% to 3% per annum, there is no expectation that COLA will provide full inflation protection. In fact, it could be much less, depending on how inflation continues to evolve.

The projected COLA of 0.85% per year would be approximately 43% of inflation, if CPI averages 2% per year (the mid-point of the target inflation rate of the Bank of Canada). If inflation is higher, COLA would represent an even smaller proportion of CPI. This means you should expect and plan for your TRAF pension to lose purchasing power over time.

How much purchasing power will I lose?

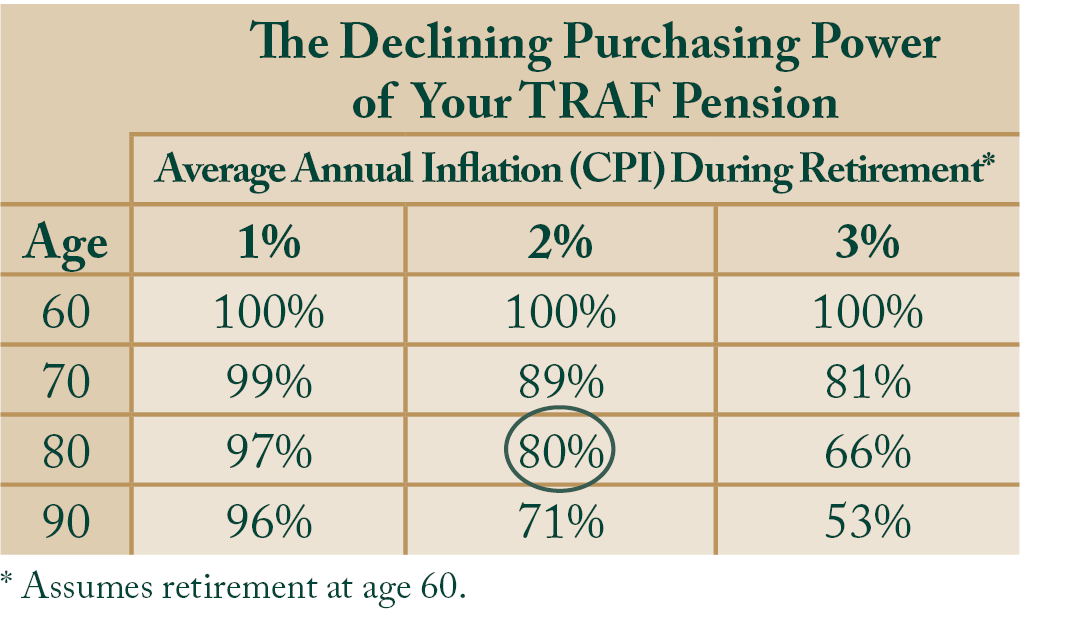

If CPI continues to exceed the amount of COLA the PAA can support, the difference between your TRAF pension and the amount at full CPI will increase over time. This may decrease the amount that can be purchased by your TRAF pension (your “purchasing power”). The following table illustrates the potential impact of inflation on purchasing power for a hypothetical member retiring at age 60 assuming COLA of 0.85% each year:

As in the circled example, with CPI at 2% per year, the purchasing power of the TRAF pension after 20 years of retirement (age 80) would be 80%, meaning the TRAF pension could purchase 80% of the goods and services it could have purchased at the time of retirement (age 60 in this example). This assumes CPI continues to represent goods and services that apply to you.

How can I keep my income in line with inflation?

While this is very much a personal issue, if you want your purchasing power to keep up with inflation throughout your retirement, you will have to plan for additional savings or consider other options.

Inflation, as measured by CPI, causes each dollar to lose its purchasing power over time. To maintain your ability to purchase the things you need and want in retirement, you could consider:

- Savings for retirement in addition to your TRAF pension (including the possibility of making additional voluntary contributions).

- Working longer.

- Ways to make additional income during retirement.

- A budget where you spend less money.

- Consulting a financial advisor to develop a personal plan.

The amount of savings required to maintain your purchasing power will depend on inflation, your goals and your personal circumstances.

Before setting a goal to solely maintain purchasing power or saving to keep your pension in line with CPI, it is important to note the following:

- CPI of a certain percentage does not mean everything went up in price by that same percentage.

- The items that you, as an individual, spend your money on may be different than those in the “basket” of goods and services used to measure CPI. More important is the items that you spend your pension on, which may increase at a different percentage than CPI.

- Your financial needs could change from year to year and over time. Travel, medical and housing expenses tend to change as our needs change and are different for everybody. For some members, expenses could increase with age. For others, they could decrease. This means that CPI may not represent the increase in your costs during each phase of your retirement.

When planning for retirement, you should also consider other sources of income, such as government pensions – Canada Pension Plan (CPP) and Old Age Security (OAS). Both CPP and OAS increase after retirement at 100% of the CPI, which means they are fully indexed and will not lose purchasing power.